Lake Elsinore Bankruptcy Attorney

Bankruptcy is a legal procedure designed to provide a debtor with a fresh start. Lake Elsinore consumers and debtors who are faced with overwhelming debt can consult with a Lake Elsinore bankruptcy attorney about how a bankruptcy can get them on the track to solvency.

A bankruptcy filing ceases all collection activity including phone calls, letters, lawsuits and seizure of assets. A Chapter 7 is a liquidation process for insolvent businesses that are winding up and for individuals whose unsecured debts, such as credit cards, medical bills and loans not secured by collateral can be discharged. A Lake Elsinore bankruptcy attorney can also help you with a Chapter 13 wage earner’s plan that can rescue homeowners risking loss of their home or car, those who have fallen behind on student loans or support payments and small business owners who wish to remain open.

Chapter 11 can be handled by a skilled Lake Elsinore bankruptcy attorney due to its complexities and formalities. Corporations, partnerships and even small businesses and individuals can file as well. A Lake Elsinore bankruptcy attorney prepares a reorganization plan that can provide a business with a path back to solvency.

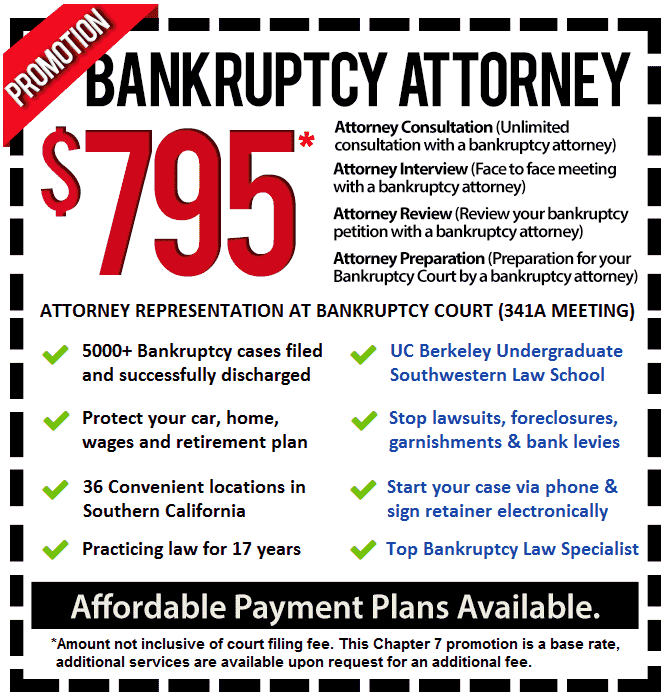

Avoid drastic measures or having to borrow more funds by calling a Lake Elsinore bankruptcy lawyer at 951-916-0091 about your financial situation.

Chapter 7 Bankruptcy

Consult a Lake Elsinore Chapter 11 bankruptcy attorney about your eligibility to file Chapter 7. Your Chapter 11 bankruptcy attorney will see if  your income for your household size is below the state median or if you can pass a means test. Most Lake Elsinore residents do qualify. You will then take a debt counseling class that provides you with a repayment plan that may not be workable. If not, then a petition is prepared listing your assets, debts, household expenses and particular transactions over the previous 1 to 2 years. Exempt and non-exempt assets are also listed by your Chapter 11 bankruptcy attorney.

your income for your household size is below the state median or if you can pass a means test. Most Lake Elsinore residents do qualify. You will then take a debt counseling class that provides you with a repayment plan that may not be workable. If not, then a petition is prepared listing your assets, debts, household expenses and particular transactions over the previous 1 to 2 years. Exempt and non-exempt assets are also listed by your Chapter 11 bankruptcy attorney.

Most debtors only attend a single meeting with the trustee who reviews your petition. Any issues can be handled by the Chapter 11 bankruptcy attorney. In most cases, you retain all your personal assets at the conclusion of your case. A discharge is usually granted about 4 to 6 months after filing with all unsecured debt wiped clean. Talk to a Chapter 11 bankruptcy attorney to see if this can work for you.

Chapter 13 Bankruptcy

If a foreclosure or repossession of a car or boat is imminent, a Chapter 13 can stop the process and give you some time to save funds for a repayment plan. A Lake Elsinore Chapter 13 bankruptcy lawyer prepares the plan for the trustee’s approval that includes arrearages on loans and pays creditors based on their status and priority. If a business, this can include employee wages.

You make a single payment to the trustee over a 3 or 5 year period, but you do have to keep loan payments current each month. Debts cannot exceed $1,184,200 for secured and $394,724 for unsecured though these limits rise every 3 years. A Chapter 13 bankruptcy lawyer may strategize to keep you within these limits if an issue.

Unsecured creditors are paid last, if at all. At the end of the plan period, any unsecured debt is discharged. Talk to a Chapter 13 bankruptcy lawyer about how debts like second mortgages can be wiped clean.

Should an emergency interrupt your monthly payments, a Chapter 13 bankruptcy lawyer can seek to modify it.

Chapter 11 Bankruptcy

Chapter 11 is a reorganization process for Lake Elsinore corporations, partnerships and small businesses. A Chapter 11 bankruptcy attorney with considerable experience handles these cases as they involve complicated reporting requirements and other formalities. Some businesses may find themselves forced into a Chapter 11 by their creditors.

This procedure has a Chapter 11 bankruptcy attorney prepare a reorganization plan for confirmation by the debtor’s largest creditors who may form committees based on their status. In some cases, they can submit their own plans if they do not confirm the debtor’s.

Once confirmed, the bankruptcy court oversees the major decisions of the business including selling assets, expanding some operations, re-negotiating leases and contracts and other material matters.

If a small business, a Lake Elsinore bankruptcy lawyer can advise owners about fast tracking the process to avoid many of the complex reporting and filing requirements and other procedures that can speed the process at a cheaper cost.

Even individual debtors with substantial debt who cannot file Chapter 7 or 13 can file a Chapter 11.

Bankruptcy is not necessarily for every Lake Elsinore consumer or business. See if a bankruptcy is the solution to your financial woes by calling a Lake Elsinore bankruptcy lawyer at 951-916-0091 today.